Singapore-headquartered AI credit modelling FinTech finbots.ai secures a leading bank client in Brunei

February 9, 2023

finbots.ai’s credit modelling solution will enable Baiduri Bank to modernise their credit risk management and develop high quality credit risk scorecards faster and more cost effectively, at scale.

Singapore, 09 February 2023 – Accel-backed finbots.ai, a Singapore headquartered B2B SaaS FinTech, today announced securing a deal with Brunei’s Baiduri Bank, to modernise their credit risk management using AI.

Baiduri Bank is one of the largest providers of financial products and services in Brunei Darussalam and serves diverse customer segments ranging from retail, MSMEs to corporate and institutional clients. The bank has also been a front-runner in adopting modern technologies and has received a number of international accolades, including the ‘Best Bank in Asia-Pacific’ for Brunei by Global Finance, ‘Best Banking Group’ for Brunei by World Finance, ‘Best Bank’ for Brunei by Euromoney, ‘Domestic Retail Bank of the Year’ for Brunei by Asian Banking & Finance and ‘Bank of the Year’ for Brunei by the Banker, UK.

Adopting finbots’ AI credit modelling solution, creditX, will enable Baiduri Bank to develop and deploy high quality credit scorecards at a fraction of the time and cost. This will result in reduced credit risk, improved efficiency and greater agility for retail and SME businesses and accelerate the bank’s financial inclusion drive for the underserved credit market.

With this move, Baiduri Bank will be the first bank in Brunei to migrate to an AI-led credit risk management solution. The pivot to finbots.ai is part of Baiduri Bank’s strategic investments in business transformation journey and leveraging technology to elevate operating efficiencies, analytics capabilities, and customer experience.

Baiduri Bank engaged IDC to undertake a thorough market evaluation and finbots.ai was selected to meet their current and future needs on credit risk management.

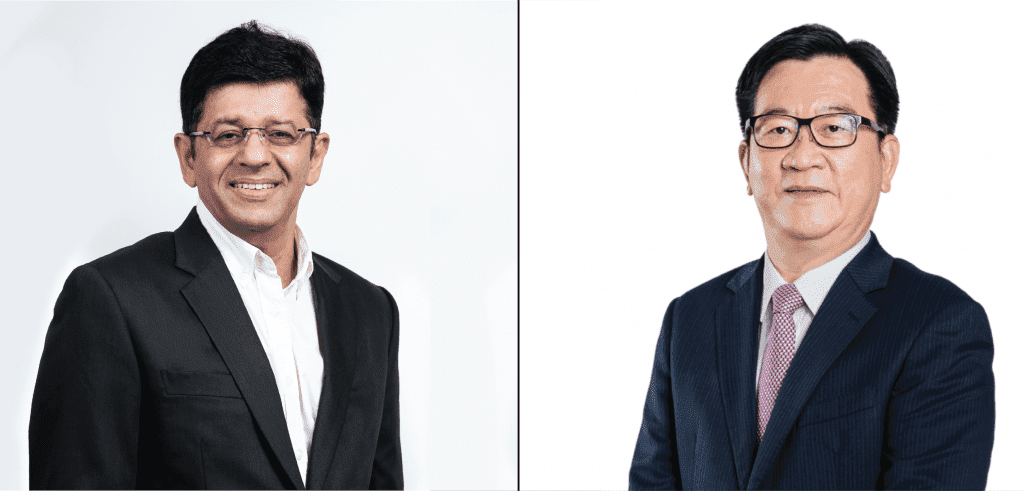

Sanjay Uppal, Founder and CEO of finbots.ai said, “We are proud to add a leading and progressive bank like Baiduri Bank to our fast-growing client base. creditX will radically transform the bank’s credit risk management value chain and open new opportunities for them to democratise access to credit at scale, speed and a fraction of the cost. We are seeing strong demand for creditX from financial services providers big and small globally, and this deal is a further testament of our solutions capability to empower lenders for smarter, faster, and inclusive lending.”

Ti Eng Hui, CEO of Baiduri Bank said, “The use of new technologies and advanced predictive analytics for credit scoring creates fresh opportunities for banks to enhance the credit-decisioning process, thereby strengthening risk management and operational efficiency. It is also one of the fundamental building blocks of a seamless omnichannel onboarding experience. As a leading financial institution, we want to partner with the most innovative companies and finbots.ai’s solution, creditX, is a game-changer in credit modelling that supports our digital transformation journey.”

Cyrus Daruwala, Managing Director, Global Financial Services at IDC added, “Baiduri Bank, and its leadership team have always believed that technology-led, customer experience will set them apart from other banks in the region. It was no surprise that when it came to their bread-and-butter business of lending, they took a similar approach. To help them future-proof their credit modelling (and risk mitigation) we short listed multiple vendors in that space. finbots.ai came up as the clear winner. In our opinion they are one of the only solutions in the market with a no-Code, AI-powered, SaaS based credit decisioning offering.”

finbots.ai has recently successfully completed A.I. Verify pilot, the world’s first AI governance testing framework and toolkit developed by Singapore Government’s IMDA (Infocomm Media Development Authority) and PDPC (Personal Data Protection Commission). This validated the performance of creditX solution on principles of fair, explainable and trustworthy AI, in an objective and verifiable manner.

Other Articles

-

Fintech Galaxy Launches Open Banking Credit Scoring Capabilities in Partnership with Singapore’s FinbotsAI

-

Singapore-headquartered AI Credit Scoring Fintech FinbotsAI to transform credit risk management for Myanmar’s largest privately-owned bank, KBZ Bank

-

Singapore-headquartered Fintech finbots.ai partners with EDOMx to Scale Faraja BNPL business